1. Failures in the High Street (Martin Powell)

Martin Powell

Martin Powell is Director of Goldratt Solutions Ltd. and The Goldratt Centre Ltd.

He is the Founding member of TOCPA.

Martin Powell has been implementing TOC, training clients and other consultants in all aspects of TOC for over 20 years. His implementations and assignments have covered Operations, Supply Chain, Distribution, Project Management, Sales and Marketing, TOC Accounting and Measures and have been spread over more than 20 countries.

This chapter was written in 2011.

In the middle of 2011 some major UK High Street brand names were brought to their knees, with the devastating effect of more losses of UK jobs. Remember how, in the 1990’s all those manufacturing jobs went because UK manufacturing was not competitive enough! Is the same happening in Retail?

These failures in Retail are usually caused by the businesses just running out of cash – in other words they have borrowed too much, their inventories are too high and when sales drop so does the cash flow. The banks lose confidence and pull the plug.

Let us explore where the real problem lies for retail.

In order to be an ever flourishing (as Dr Goldratt termed it) retail business, the management has to do a balancing act – both stability and growth are important. This means building their own competitive advantage without taking too many risks.

Traditionally, the approach is to try to gain an advantage from lower prices and physical presence. The price advantage they strive for comes from buying more and more from the far east and emerging countries where the wages and cost of production are lower. However, this approach has disadvantages mainly in the form of much longer lead times to get supplies to the UK, quality issues and very large minimum order quantities.

The physical presence advantage that they strive to get is by opening more and more stores in an already saturated market. This pushes up their operating costs, such that when a downturn happens they have to close many stores in order to survive.

The real way to gain the advantage without taking too many of the risks mentioned above is to satisfy significant consumer needs better than any significant competitor can. So the question we should then ask is – what is the consumer’s significant need? We can say price; we can say quality – however, if the products are not AVAILABLE then price and quality are secondary. The most important need for even standing a chance of making a sale is availability.

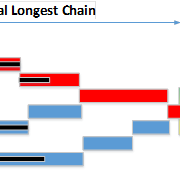

Expecting to find an SKU and being disappointed severely erodes the consumer’s impression of good availability. Shelf space is usually the shop’s constraint for better availability. A significant amount of the constraint is captured by merchandise that was ordered according to an overly optimistic forecast. Offering many products that the market doesn’t want is not contributing to the impression of availability. When the product’s market-life is not long, the slow reaction time of the supply chain causes the offering to be based more on educated guesses, rather than on actual market preferences.

Shortages are the main reason for a consumer’s disappointment.

The current mode of operation of most supply chains, a mode of operation that is based on forecast, causes the supply chain to have a long replenishment lead time. A long replenishment time causes shortages and high inventories that block the shelf space and impair the ability to adjust the offering to the actual market preferences.

Shortages and high inventories do not only erode availability, but also (dramatically) reduce sales and increase investments.

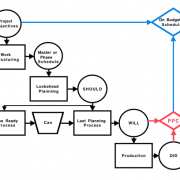

So the pivotal change, the “What to change?”, is to stop operating according to forecast.

The direction for the solution, the “what to change to?”, is to start using TOC Pull-distribution – switching to a mode of operation which is based on actual consumption. Under this counter-intuitive approach, whatever is sold to the consumer is replenished to the stores from warehouses – let’s say Regional Distribution Centres – on a very frequent basis (e.g. daily). The shorter the frequency, the less quantity that the store needs to hold as inventory and hence with the same space, the greater the range of products is can hold and display. The RDCs are replenished – what was shipped to the stores – frequently (e.g. weekly) from a Central Distribution Centre. At both the RCD and the CDC we gain the advantage of aggregation – which means that the variability in demand is much narrower than at the store level.

For Retail this switch to frequent replenishment of actual demand, together with a proper incentives scheme to the suppliers (or better, to have suppliers which use the same consumption-based mode of operation), ensures very high availability coupled with surprisingly high inventory turns.

Of course there are many “yes I see the benefits of the direction but ……” reservations. What about new products? What about running full trucks? What about seasonal products? What about …..?”

All of these reservations can and have been dealt by companies that have implemented it, although the exact way each is handled depends very much on the specific case and the decisions of management. These reservations are dealt with under the heading of “how to cause the change?”.

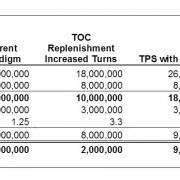

First we have to ask ourselves –is pursuing this direction worth it. To answer this let us review briefly four recent public presentations of results (we do not have permission to disclose company names in this article). If you are the sort of person who looks at what others have done and usually says “yes I can accept that they got results but we are different……” then stop reading this article now. If you are more open to see the commonality then read on.

Case 1 – Liberty Shoes

This organisation, based in India, is in the top 5 footwear companies in the world with over $100m sales and producing 50,000 shoes per day. The company produces varieties of ranges covering virtually every age group and income category. The products are marketed across the globe through 150 distributors, 350 exclusive showrooms and over 6000 multi-brand outlets, and sold in thousands every day in more than 25 countries including France, Italy, and Germany. The outwards supply chain includes 120 Distributors / Wholesalers (who sell through 10,000 multi-brand stores) and their own retail chain of 30 stores and 400 franchise stores.

Prior to the TOC implementation the five production plants were supplied with components, raw materials and some finished product by the vendors. The plants then sent the products direct to the Distributors and their own and franchise stores. The plants were competing with each other to sell product and generally they operated on a “push” basis. The results of the way they were managing, for the company, were:

- 130 days of stock

- 70% availability

- Flat sales for 3 years

- Not making profits

- More than 400,000 pairs of shoes as non-saleable stock

For its customers, Distributors and franchisees the results were:

- 1.0 to 1.4 inventory turns

- Barely making profits

- Being supported by the company with huge discounts

- Surplus stock older than 1.5 years

For their own retail stores the results were:

- 1.5 inventory turns (8 months cover)

- Huge stock outs and surpluses

- Sales stagnant

- 4 years of losses

- Inventory investment was blocking expansion

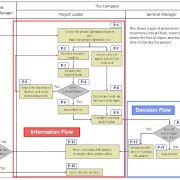

Before the implementation started the whole of the company’s management were conducted through a consensus process covering “What to change – What to Change to – and How to Cause the Change” by the chosen TOC Consultants. This concluded with a full implementation roadmap which included the following main steps, which were implemented:

- Central planning for all 5 plants

- Central sales for all 5 plants

- Established a Central Warehouse (aggregation point), to which all the plants supply. They do not supply to customers directly now.

- Plants transformed from “Making to Stock” into “Making to Availability” (stock buffers) and Buffer management

- All Raw Materials and components on “Purchase to Availability” and Buffer management

- Implemented dynamic replenishment with suppliers

- The shops send weekly orders to the Central Warehouse

- Replenishment weekly

- Order generation and dispatch of individual SKUs rather than All Size Packs

- New introductions of smaller range, 8 times a year

The results after one year of implementation in the retail chain were:

- Inventory – down from 8 months cover to 4 months (like for like stores)

- Availability up from 70% to 95%

- Sales increased by 64%

- New range introductions up from 2 per year to 8 per year

- Inventory turns of distributors and franchise stores tripled

The biggest gain is risk free expansion. The stores were operating profitably on 5 inventory turns. This means that huge amounts of capital had been released for investment in new stores, which require less than half the starting inventory compared to before the implementation.

In summary the closer alignment of supply with actual demand has increased sales at the same time as reducing inventory. This enabled the released cash to be re-invested in store expansion driving up sales even further. Gaining more franchisees is now easier with a lower inventory investment needed for the same level of business.

Case 2 – Titan Jewellery

This organisation, based in India, has over $1bn of sales through 150 stores. This industry typically has very low inventory turns with severe peaks of demands leading up to “special days” – such as one would expect for Valentine’s Day.

The pre-implementation scenario was that the stores were collectively holding, on average, about $3.5 million of inventory. Each store held approximately 5000 SKUs with one piece of each. The average daily sales for a store were 50 SKUs per store and inventory turns of 3.

Before the implementation started the whole of the company’s management were conducted through a consensus process covering “What to change – What to Change to – and How to Cause the Change” by the chosen TOC Consultants. This concluded with a full implementation roadmap which included the following main steps, which were implemented:

- Improving the availability of “best sellers” – fast movers

- Create a central buffer to support fast movers (about 3% of SKUs)

- Auto replenishment of sales by the stores within 3 days

- Dynamic Buffer Management

- Regular review of “best sellers” by store and those not selling are returned to central buffer

- Stores able to choose products they want to trial

- Improving the supply and variety to the stores

- Implement Pull Distribution and Buffer management – from stores through to central warehouse – through to Production and Vendors

- Daily systematic process at stores, based on what is selling, to request product or closest variant from centre

- Support seasonal peaks with central inventory with fast supply, rather than individual store forecasts

- Refreshing slow movers

- Match the slow movers in one store with a store where the SKUs are selling – recall the SKUs back to centre and redistribute

- Replace recalled SKUs with others chosen by the store

- More effective new product introduction

- Stop the major bi-annual introduction of 10,000 new items

- Introduce refreshers only in categories and price bands that need them

- Proper testing in restricted store before becoming widely available

- Use a rotation approach around the stores so that they are always having something new – meaning that particular store has not had it before

The results after 1.5 years of implementation in retail are:

- Stock turns increased by 22%

- Sales increased overall by 12%

- For the main “special day” time period;

- 58% increase in sales

- 19% reduction in inventory

In summary the closer alignment of supply with actual demand has again increased sales at the same time as reducing inventory. In this sector the margins on gold are significant, so the sales increase with little increase in operating costs has a very significant impact on the profitability.

Case 3 – Big Frango – Chicken Products (Fresh/Frozen)

This organisation, based in Brazil, has over $350m of sales operating from 3 plants and through 6 distribution centres. Their sales are segmented 50% Retail, Wholesalers 20% and Export 30%.

This case started with the usual Data Collection by the chosen TOC Consultants. An Executive Worksop followed with the senior management of the company. The core conflict identified was:

A: The common objective was to increase return on investment

The two necessary conditions were:

B. Increase sales

C. Reduce inventory

The conflicting actions were:

D. In order to increase sales we must push inventory along the outwards supply chain

D’ In order to reduce inventory we must let inventory be pulled along the outwards supply chain

The paradigms in the supply chain that needed to be changed were identified as:

- Local optimum – For one to win the other one link in the chain needs to lose

- Economic Order Quantity “saves” costs

- Suppliers are not reliable

- Inventory must be closer to the consumption point

- Better Truck utilization is highly important

- Retail gets better prices for buying high quantities

It was agreed to conduct a pilot implementation in part of the supply chain, in order to determine not only the magnitude of results but also the challenges of a full implementation.

The approach had to create a new relationship based on “I want to make money with you, not from you ….!”

The constraint of supply was identified as the production capacity. The exploitation was therefore to focus on the most profitable products (Throughput Per Shelf) and move sales from Wholesalers to Retail. A major challenge was considered to be getting the retailers to provide their daily sales at an SKU level; however, this was part of the selling of the “inventory turns” offer to customers. So the obstacle was overcome with a value based selling process and education of the sales team.

Nine key strategies were implemented:

- Daily retail inventory and sales information (SKU level)

- Increase SKU replenishment frequency

- Sixty days prices agreements

- Inventory levels redefinition for each warehouse and store

- Inventory Aggregation

- Dynamic buffer management implementation (Big Frango and Retailers)

- TVD and IVD Implementation – Throughput-Value-Days to measure lost sales and Inventory-Value-Days to measure inventory

- Shelf space negotiation

- Sales team measured by actually satisfied sales and product mix rather than volume

During the 3 months pilot implementation (not all plants and distribution centres):

- Sales growth was 82%

- Out of stock risk was reduced by 65% – measure by TVD

- Reduction in inventory was 57% – measured by IVD

- Market drop in price 6% – their prices increased by 5%

Additional benefits were more fresh products on the shelf; higher customer loyalty; and less stress between parties.

In summary the closer alignment of supply with actual demand has produced significant impact through to the bottom line. The additional main feature of this case is the change in the relationships in the supply chain from “confrontational” to “collaborative” because everyone wins from the solution.

Case 4 – Cosmetics

This organisation has over $2.5bn of sales through 2,000 points of sale in Brazil and over 1,000 points of sale in 9 other countries. This industry is typified by severe peaks of demands, especially driven by promotions and around “special day” campaigns.

The company has one plant with one Distribution Centre (located 135 miles away from the plant). The DC sends products weekly to all 300+ stores as there are no Regional DCs. The environment is subject to high demand variability. There are about 600 active products with 200 launches of new products per year but the increase in demand can be as much as 1000% in one month for some SKUs. The organisation was also suffering from limited supply chain visibility – making decision making more difficult.

Their undesirable effects were – too many out of stock situation at the franchisees; inventory coverage was too high; difficulty planning around the large number of promotional campaigns.

The basic solution was to move to Replenishment and Make to Availability with Buffer Management. However, there was concern that the regular solution and algorithms would not react fast enough to the sudden rises in demand. There was also concern that the MTA Buffer method relies on historic data about consumption and that for the many new products, no such data was available. The designed solution was to have a hybrid system, where regular demand drives MTA (pull) and Special Events or Promotions were driven by Forecast (push).

The pilot implementation covered 2 large franchisees with collectively 150 points of sale. There was significant preparation work needed to build collaboration with the franchisees before launch. This took 3 months. The targets set for the following 3 months of the pilot implementation were:

- Inventory turns to be increased by at least 20%

- Stock-outs to be reduced by 30%

In order to make this two system approach (pull and push) effective it was needed to introduce a “Collaborative Demand Planning for Events” process and a weekly “Collaborative Replenishment” process.

Under the Events process, the company, particularly manufacturing (so they can support the plan), prepares a statistical forecast based on past data and events. This is sent to the franchisees for feedback and adjustment. Once agreed this forms the basis of a push of product from the centre to support the event.

Under the Replenishment process, weekly each store inventory is adjusted for consumption and as needed the buffers changed. The planned replenishment according to the buffers is sent to the franchisees for approval. This helps with the buy-in of the store managers to the new system such that by the end of the pilot several of the stores were running on automatic replenishment.

In summary, the pilot was extremely successful.

- Sales increased by 60% with a reduction of inventory

- Stock-outs were reduced by 38%

Conclusion

So these cases, which are just a sample, indicate that the TOC Pull Distribution solution brings huge benefits, in inventory reduction; sales increases; less stock outs; investment expansion; more collaboration and less stress. The cases show some of the variations needed to the standard solution.

If you would like to read more about how to approach retail, then we recommend the book (novel) “Isn’t It Obvious” By Dr Goldratt. The assumptions, challenges and actions needed are woven throughout this book but answers are not handed to you. As you read, along with the characters in the book, you work through the process together to discover and understand the solutions and how they are implemented.

All materials available on the TOCPA site are the intellectual property of their authors and cannot be reproduced in any other media and used for any purposes without the prior permission in writing of the authors.

Leave a Reply

Want to join the discussion?Feel free to contribute!